10222019 An s corp basis worksheet is used to compute a shareholders basis in an s corporation. Your share of any net income generated 3.

Pin On Ansoff Matrix Template By Ex Mckinsey Consultants

Pin On Ansoff Matrix Template By Ex Mckinsey Consultants

Consider saving all Schedules K-1 to the companys.

S corp basis worksheet excel. Lets keep life simple and easy for you. S Corp Basis Worksheet UpCounsel 2020. Capital gain 0.

Get Started On Your Application Now. On this page you will find. Shareholders Basis Worksheet FAQs.

As mentioned before you do not have to replicate data that is available elsewhere. The Following Line Numbers Refer to the Line Numbers on the Shareholder Basis Computation Worksheet that the S-Corporation Program Produces. If a complex situation comes up tackle it right away not 10 years down the road when information and memories are incomplete.

Get Started On Your Application Now. Instructions for Downloading the S-Corp Tax Organizer for your Business How. Additional capital contributed including loans by shareholders to the corporation that have not been paid back 4.

This amount should be entered in the Basis Limitation section in Adjusted basis at beginning of year -1 none Ctrl E MANDATORY Screen 202. Thats why you hired us. Ad Prepare Immigration Application Online.

Distribution 2 Page 221. Line 1 Stock basis at beginning of tax year. Normally a shareholder that has basis in the company can reduce their other income W-2 wages interest dividends rental etc on their personal tax return with the losses of the company.

Shareholders who have ownership in an S corporation must make a point to have a general understanding of basis. Each block of stock is accounted for separately. For example mortgage interest and real estate taxes reported on Form 1098 do not need to be entered again with our worksheets.

Basis is tracked at both the 1120-S level and the 1040 level however the worksheets are not always the same between the 1120-S and 1040 returns. Shareholder Stock Basis Type Text Here Likely a tool available in your tax software but. Ad Prepare Immigration Application Online.

Worksheets Available Here is a list of our worksheets. EP Distributions are first a return of stock basis Excess treated as a gain from sale of stock IRC Sec. No basis will come from retained earnings during time as C-Corp.

The amount if any that you paid to another shareholder to acquire their stock - 5. 2152008 Generally your basis in the S corp is going to be 1. How does the Shareholders Basis Worksheet calculate the basis limitation on the deductibility of a shareholders share of the S Corporations losses.

Of basis 60K Tax free 2 nd. For stock received by gift the lesser of donors. This tax worksheet calculates an S Corporation shareholders basis in stock and debt for transactions that occur during the year.

Income per K-1 50K. Please see the last page of this article for a sample of a Shareholders Basis Worksheet. 112012 The best advice to a practitioner regarding S corporation basis is to begin with the end in mind Start tracking stock basis from day one and keep tracking it.

Stock basis is also adjusted when shareholders buy sell or transfer shares. This article refers to screen Shareholders Adjusted Basis Worksheet in the 1120-S S corporation package. 5000 LTCG 0.

Click the following links to read answers to common questions about processing Shareholders Basis Worksheets. Original investment capital contributed 2. If loan basis has been reduced in prior years subsequent income passed through the S corporation must be applied first to restoration of loan basis.

Completing a Tax Organizer will help you avoid overlooking important information and contribute to an efficient preparation of your tax returns. What losses and deductions are included in the. For losses and deductions which exceed a shareholders stock basis the shareholder is allowed to deduct the excess up to the shareholders basis in loans personally made to the s corporation see item 4 below.

49b 50a 50c2 and 1371c - basis restoration due to credit recapture. With no prior C corp. The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen.

12 - S-Corporation Basis. 1152020 Compile information for your S-Corp tax return with ease using one of our 2019 S-Corp Tax Organizers. Worksheet showing Net Basis of Assets less Liabilities Exchanged.

The Spreadsheet Page Data Form Home Data Form Data Entry Data

The Spreadsheet Page Data Form Home Data Form Data Entry Data

Valid Business Case Template For Additional Staff Business Case Template Business Case Business Template

Valid Business Case Template For Additional Staff Business Case Template Business Case Business Template

Shareholder Basis Worksheet Excel Promotiontablecovers

Shareholder Basis Worksheet Excel Promotiontablecovers

Life Hack Productions Useful Life Hacks Life Hacks Fun Facts

Life Hack Productions Useful Life Hacks Life Hacks Fun Facts

Psychosocial Assessment Assessment Social Work Sample Resume

Psychosocial Assessment Assessment Social Work Sample Resume

Peer To Peer Lending An Alternative Source Of Finance Peer To Peer Lending P2p Is A Relatively New Peer To Peer Lending Accounting And Finance Finance

Peer To Peer Lending An Alternative Source Of Finance Peer To Peer Lending P2p Is A Relatively New Peer To Peer Lending Accounting And Finance Finance

Free Sample Example Format Download Free Premium Templates Communications Plan Communication Plan Template Simple Business Plan Template

Free Sample Example Format Download Free Premium Templates Communications Plan Communication Plan Template Simple Business Plan Template

Shareholder Basis Worksheet Excel Nidecmege

Shareholder Basis Worksheet Excel Nidecmege

Affidavit Of Truth Template 5 Templates Truth Words

Affidavit Of Truth Template 5 Templates Truth Words

Services Proposal Template Free Best Of 12 Service Proposal Templates Word Pdf Pages Proposal Templates Free Business Proposal Template Free Proposal Template

Services Proposal Template Free Best Of 12 Service Proposal Templates Word Pdf Pages Proposal Templates Free Business Proposal Template Free Proposal Template

Trade Reference Template 1 Reference Letter Template Reference Letter Letter Templates

Trade Reference Template 1 Reference Letter Template Reference Letter Letter Templates

Shareholder Basis Worksheet Excel Promotiontablecovers

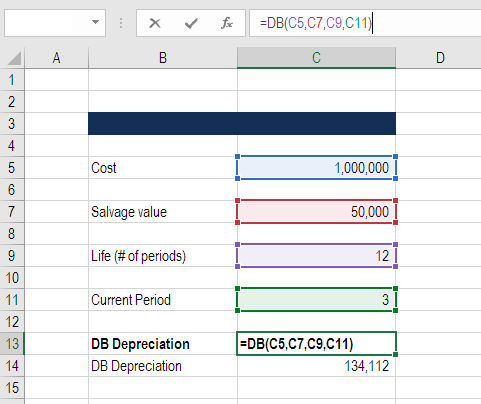

Excel For Finance Top 10 Excel Formulas Analysts Must Know

Excel For Finance Top 10 Excel Formulas Analysts Must Know

Sales Report Template In Excel Free Download Xlsx Temp Sales Report Template Report Template Sales Template

Sales Report Template In Excel Free Download Xlsx Temp Sales Report Template Report Template Sales Template

Chart Difference Between Psychology Vs Leadershipcoaching Psychology Careers Leadership Coaching Psychology

Chart Difference Between Psychology Vs Leadershipcoaching Psychology Careers Leadership Coaching Psychology

Honeywell International Business Model Canvas Business Model Canvas Business Model Canvas Examples Business Model Example

Honeywell International Business Model Canvas Business Model Canvas Business Model Canvas Examples Business Model Example

Search This Blog

Labels

- 1000

- 1040x

- 1080p

- 11th

- 13th

- 1400

- 1920x1080

- 1940

- 1940s

- 1960s

- 1972

- 2015

- 2016

- 2017

- 2018

- 2019

- 2020

- 2021

- 21st

- 2560x1440

- 35th

- 3840

- 44th

- 49ers

- above

- abstract

- academy

- acar

- accent

- accounting

- Action

- active

- activities

- actress

- acwy

- adding

- address

- adidas

- aditya

- adjectives

- adjust

- adults

- aesthetic

- africa

- african

- afterpay

- again

- agar

- agave

- agency

- ages

- agreement

- agrem

- aguilar

- aids

- airplane

- airpods

- alabama

- album

- algebra

- alien

- allstate

- aloe

- alpha

- alphabet

- alphabets

- altitude

- always

- amazing

- amazon

- ambe

- america

- american

- amman

- among

- amparan

- amphibians

- amsterdam

- anak

- ananbo

- anaphylaxis

- anatomy

- ancient

- android

- aneka

- angeles

- animal

- animals

- animated

- Animation

- anime

- anjaneya

- ankle

- anniversary

- answer

- anti

- antibodies

- apartments

- apology

- apple

- application

- approach

- aquarium

- arabian

- archer

- arches

- arctic

- area

- ariana

- ariel

- army

- arrangement

- arranging

- arsenal

- articles

- artinya

- artist

- asam

- asap

- asem

- asian

- asin

- asinan

- aspen

- astrazeneca

- audio

- audubon

- australia

- authentic

- autism

- auto

- autumn

- average

- aviation

- avrist

- awug

- ayam

- azlef

- aztec

- baba

- babat

- babi

- baby

- bacem

- back

- backdrops

- background

- backgrounds

- backsplash

- backyard

- badass

- badges

- bagea

- bail

- bailey

- bakar

- bake

- bakpao

- bakso

- bakwan

- balado

- bali

- ball

- balls

- balok

- banana

- bandeng

- bands

- bandung

- bangket

- bangkit

- banjarnegara

- bank

- banner

- bantal

- bape

- barbell

- barbeque

- barongko

- baru

- basah

- basil

- basis

- basket

- batang

- bath

- bathroom

- battery

- bavaria

- bawang

- bayam

- beabadoobee

- beach

- bean

- beans

- bear

- bearings

- beast

- beatrice

- beautiful

- beauty

- became

- become

- bedda

- bedroom

- bedrooms

- beds

- beer

- beginning

- behind

- beige

- being

- believe

- below

- benefits

- beras

- best

- between

- bhagavad

- bhagwan

- bhagwat

- bible

- bicicletas

- bike

- bikes

- bikin

- bill

- billed

- binder

- biome

- birch

- bird

- birds

- birthday

- biru

- bistik

- bite

- bivalent

- black

- blanc

- blank

- blessings

- bligo

- bloodborne

- blossom

- blue

- bluetooth

- blush

- board

- body

- boeing

- bogasari

- bohemian

- boho

- bola

- bollywood

- bolu

- bonsai

- bonus

- book

- boost

- booster

- boot

- boots

- boston

- botanical

- bottom

- bouquet

- boxs

- boys

- brain

- branches

- brand

- bread

- break

- breakfast

- breast

- brick

- bridal

- bridge

- bridgewood

- bright

- british

- brokers

- bronco

- bronze

- bros

- brothers

- brownies

- brucellosis

- brush

- brushes

- bryant

- bryce

- buat

- bubuk

- bubur

- buddha

- buffalo

- bugs

- build

- bulan

- bulb

- bulbasaur

- bullet

- bumble

- bumbu

- bunga

- bunny

- burger

- business

- businessman

- butterflies

- butterfly

- buying

- cabinet

- cactus

- cafe

- cake

- cakes

- cakwe

- calculate

- calculator

- calendar

- california

- call

- calm

- calorie

- camaro

- camera

- cameras

- camouflage

- camp

- canada

- canine

- cannabutter

- canvas

- canvases

- capacity

- captivate

- cara

- card

- cards

- caregiver

- carl

- carpet

- cars

- carters

- cartoon

- carved

- case

- cash

- castle

- cats

- cattle

- cbr1000rr

- cecek

- ceiling

- celebrity

- cell

- cellar

- cellphone

- cemilan

- cendol

- center

- century

- ceramic

- chair

- chairs

- chalk

- chanel

- change

- changer

- channel

- charge

- charger

- charizard

- charles

- charm

- charmander

- chart

- charts

- cheap

- cheapest

- cheater

- check

- checklist

- cheesecake

- chemical

- cherry

- chevy

- chicken

- chickenpox

- child

- childrens

- chill

- chinese

- chips

- choco

- chocolate

- chords

- christ

- christmas

- chromebook

- church

- churros

- cilacap

- cilok

- cina

- cite

- city

- cityscape

- civic

- claims

- clancy

- class

- classic

- clay

- clean

- clemson

- cleveland

- clipart

- clips

- clothes

- cloud

- clover

- coats

- cockpit

- coco

- coconut

- codes

- coefficient

- coffee

- coin

- coklat

- cold

- collar

- collars

- collectible

- collection

- color

- colorado

- colored

- colorful

- coloring

- colour

- come

- command

- commercial

- commission

- companies

- company

- comparison

- comprehension

- computer

- concrete

- conditioner

- condo

- cone

- connect

- consolidated

- container

- continental

- contract

- contractions

- contraindications

- controller

- cool

- copy

- copyright

- copyrighted

- core

- corner

- corners

- coronavirus

- corps

- corvette

- cost

- cotman

- cottage

- cottonee

- counters

- country

- countryside

- coupe

- couple

- couples

- coupon

- coupons

- courtyard

- cover

- covered

- covid

- coyote

- crasher

- crate

- cream

- creamer

- creamy

- create

- creative

- creatures

- cricut

- crispr

- crispy

- crop

- cross

- crown

- crucible

- cryptocurrency

- cuban

- cube

- cumi

- cups

- curriculum

- cursive

- custom

- cute

- daerah

- daging

- dago

- daisy

- dakota

- dalgona

- dallas

- dari

- dark

- data

- date

- dates

- davidson

- dawet

- debby

- debt

- decimal

- deck

- deco

- decor

- decorate

- decorating

- decoration

- dedica

- deductible

- definition

- degree

- delete

- delonghi

- demon

- denali

- dental

- denver

- deodorant

- deportivo

- depot

- depression

- desain

- desert

- design

- designer

- designers

- designs

- desk

- desktop

- devi

- device

- devices

- dhpp

- diabetic

- diabetics

- dialogue

- diamond

- diana

- diario

- dibuat

- dicks

- digest

- digital

- dinner

- dirt

- disney

- dispenser

- distribution

- distributive

- division

- dodger

- does

- dogs

- doll

- dollar

- dolls

- donat

- donate

- dont

- donuts

- door

- doors

- dorang

- dorm

- dormify

- dose

- double

- down

- download

- downloads

- dragon

- dragonite

- drawings

- dream

- dress

- dresses

- drive

- drone

- dslr

- dualshock

- duck

- duke

- dungeon

- durga

- durgamata

- dust

- duty

- dwayne

- eagle

- easter

- easy

- ebola

- edge

- editing

- edition

- education

- eevee

- eeveelution

- effect

- effective

- effects

- efficacy

- eggs

- election

- emerald

- emoji

- emotional

- empal

- empek2

- employee

- employment

- empty

- empuk

- enak

- engine

- english

- enterprise

- entry

- entryway

- epoxy

- ereading

- eskayel

- essential

- estate

- estaticas

- ethereum

- etsy

- euro

- evening

- evergreen

- everything

- evolve

- example

- excel

- exclusives

- exemption

- exercises

- exotic

- expansion

- explorer

- expressions

- exterior

- external

- extra

- eyeglass

- eyelash

- fabric

- face

- factor

- facts

- fairy

- fall

- Family

- famous

- farmhouse

- farthing

- fashion

- fast

- favorite

- feature

- february

- feed

- feline

- fencing

- ferret

- fewer

- fifth

- fight

- figures

- film

- financial

- find

- finger

- fire

- fireblade

- fireplace

- firestick

- first

- fish

- fisher

- fitness

- flag

- flamengo

- flames

- flavors

- floor

- floral

- florida

- flowchart

- flower

- flowering

- flowers

- fluency

- flyer

- fmla

- focus

- followers

- fondant

- font

- food

- foot

- footage

- football

- forces

- ford

- forest

- form

- forms

- Forms Non-Disclosure Agreement Template Free

- fortnite

- fountain

- fourth

- framed

- frames

- francais

- franchise

- frappuccino

- free

- Free Confidentiality Agreement Non-Disclosure Template

- Free Download Non-Disclosure Agreement Template

- Free Motion Graphics Templates After Effects

- Free Motion Graphics Templates After Effects Transportation

- Free Motion Graphics Templates for Adobe

- Free Motion Graphics Templates Premiere CC

- Free Mutual Non-Disclosure Agreement Template

- Free Photoshop Watercolor Portrait Brushes

- Free Photoshop Watercolor Pressure Brush

- Free Realistic Watercolor Photoshop Brushes

- Free Watercolor Brush Paint Runs Photoshop

- french

- friday

- fried

- friend

- friends

- from

- front

- fruit

- fuego

- full

- funeral

- funko

- funny

- fvrcp

- gado

- galaxy

- gallery

- game

- gamer

- games

- gaming

- ganache

- ganapati

- gandos

- gandum

- garage

- garang

- garden

- garing

- garlic

- garrix

- garten

- gauntlet

- gautam

- geblek

- geeta

- geico

- gelas

- general

- generator

- geometric

- geprek

- german

- giant

- giclee

- gift

- gifts

- gilman

- gilmore

- gingham

- giraffe

- girls

- girly

- gita

- given

- gladiolus

- glam

- glass

- glencoe

- globe

- glow

- gluten

- goat

- goddess

- gogh

- gohu

- gold

- golden

- golf

- good

- gopro

- goreng

- gorengan

- gorilla

- governmental

- gown

- grade

- grader

- graders

- graduation

- graffiti

- graphic

- graphics

- grass

- gray

- green

- greeting

- gremory

- grey

- grid

- grinch

- grinder

- grocery

- grounds

- grow

- growth

- grumbacher

- gryffindor

- guardian

- gudangan

- gudeg

- guided

- guidelines

- guitar

- gulung

- gums

- gurame

- gurih

- guys

- gwen

- haikyuu

- hair

- half

- hallway

- hand

- handwashing

- handwriting

- hang

- hanging

- hangings

- hanuman

- happy

- harga

- harley

- harry

- harvest

- hashtags

- have

- haven

- hawaii

- head

- headphones

- heads

- heal

- health

- heart

- hearts

- heels

- heroine

- hidden

- hide

- high

- highland

- hijau

- hinata

- hindi

- hippo

- hiroin

- hiscox

- holbein

- hold

- holder

- holders

- hollywood

- home

- homemade

- homeowners

- homeschool

- homework

- homographs

- honda

- hong

- hongkong

- hooch

- hoodie

- hook

- horizontal

- horse

- hotel

- hotteok

- house

- houzz

- howard

- huancayo

- huawei

- hugh

- hulu

- hunter

- hunting

- husband

- iced

- idea

- ideas

- ikan

- illusion

- illustration

- image

- images

- imagine

- immunity

- impact

- improve

- improvement

- incense

- inch

- independence

- india

- indian

- indiana

- indigenous

- indomie

- indonesia

- inferring

- infinity

- influenza

- info

- ingredients

- inhaler

- inside

- inspired

- install

- instant

- instinct

- insurance

- interior

- intervention

- interview

- into

- inventory

- invitation

- ipad

- iphone

- ipvopv

- irish

- irrigation

- islamic

- island

- istanbul

- istocno

- italicize

- italy

- jacket

- jackie

- jadul

- jahe

- jajan

- jajanan

- jakarta

- james

- jamestown

- janssen

- japanese

- jars

- jawa

- jazz

- jeans

- jeep

- jerawat

- jesus

- jewelry

- jobs

- jogja

- john

- johnson

- johto

- jordan

- journal

- jowo

- jualan

- juice

- jumpstart

- jungle

- kacang

- kakkar

- kambing

- kannada

- kaos

- kari

- katsu

- kawasaki

- kecap

- kecipir

- kegel

- keju

- kekinian

- kembang

- kembung

- kentang

- kepala

- keren

- kering

- keripik

- kerupuk

- keyboard

- khas

- kids

- kief

- kill

- killua

- kindergarten

- kitchen

- kittens

- know

- kobe

- koenigsegg

- kohls

- kojek

- kolak

- kong

- konidela

- kopi

- kornet

- koya

- kress

- krim

- krishna

- krispi

- kristen

- kroger

- kuah

- kukus

- kulit

- kumpulan

- kuning

- kupang

- label

- labels

- labrador

- labu

- ladies

- lakshmi

- lama

- land

- landscape

- language

- laptop

- large

- laris

- late

- latest

- lauk

- laurent

- laut

- lava

- lavazza

- laws

- laxmi

- layers

- leaf

- lease

- leather

- leaves

- lebron

- legends

- legs

- lemah

- lengkuas

- length

- lepto

- less

- lessons

- letter

- level

- lewis

- liabilities

- liberty

- liem

- life

- lifestyle

- light

- lighthouse

- lights

- ligne

- limited

- lion

- lions

- lipids

- list

- lists

- little

- live

- liverpool

- livescore

- load

- locations

- lock

- locker

- lodeh

- login

- logo

- london

- long

- lontong

- looking

- looney

- lord

- loss

- lost

- lotong

- love

- lovers

- lower

- lowes

- luciferin

- lulur

- lumer

- lumpia

- lumpur

- lungs

- lush

- luwak

- luxury

- lyme

- lyrics

- macaron

- macaroni

- machine

- made

- madiun

- madrid

- magnate

- mahalaxmi

- maine

- makan

- makanan

- make

- maker

- makeup

- malaria

- malaysia

- mamba

- management

- managerial

- manchester

- mandala

- mandated

- manga

- mangga

- manis

- manisa

- manisan

- manly

- mantan

- many

- maple

- maranggi

- marble

- marbles

- march

- marine

- mario

- mark

- marketing

- marmont

- marriage

- martabak

- martin

- marvel

- masak

- masakan

- mask

- massachusetts

- master

- mata

- math

- mathxl

- matrix

- mawar

- mayflower

- mayo

- meal

- meaning

- measure

- mechanism

- medan

- media

- medical

- medicare

- medieval

- meditation

- mehandi

- mein

- melancarkan

- meloetta

- melon

- meltan

- membuat

- meme

- memes

- memorial

- mendoan

- meningitis

- meningococcal

- mentega

- menu

- menyesal

- menyuburkan

- mercedes

- mermaid

- merry

- metal

- metallic

- metaphor

- method

- miami

- microsoft

- midwest

- migrate

- milk

- mind

- mine

- minecraft

- mini

- minimalist

- minnesota

- minuman

- minyak

- miss

- mites

- mixed

- mixer

- mmse

- mnemonics

- mobile

- mockup

- model

- modern

- moderna

- molen

- monday

- money

- monitor

- month

- monthly

- moon

- moran

- more

- morris

- most

- motherboard

- motion

- motivation

- motivational

- motogp

- motor

- mountain

- mounted

- mouse

- moveset

- movie

- moving

- mpek2

- mrna

- much

- mudah

- muhammad

- muharram

- multi

- multiple

- multiplication

- mundo

- municipal

- murah

- mural

- murals

- muriels

- muscle

- mushrooms

- Music

- must

- mustang

- mutiara

- nails

- namaste

- name

- names

- nanas

- nanny

- narayan

- narrative

- nasi

- nastar

- national

- nativity

- natural

- nature

- nautical

- navratri

- navy

- near

- nechar

- neck

- necrozma

- need

- neha

- neil

- neon

- nescafe

- netgear

- News

- newton

- nice

- night

- niharika

- nike

- nintendo

- nissan

- noose

- northern

- nots

- novel

- november

- nugget

- number

- numbers

- nursery

- nutrisari

- oatmeal

- obat

- oblong

- ocean

- octopus

- office

- official

- offline

- often

- olahan

- older

- olds

- oliver

- omaha

- online

- ontario

- open

- opening

- orang

- orange

- orca

- orchid

- oregon

- oriental

- original

- ornaments

- other

- outback

- outdoor

- outdoors

- oversized

- owner

- pacar

- packers

- packs

- padang

- padeh

- padlocks

- pages

- pain

- paint

- paintable

- painting

- paintings

- pair

- pakistani

- palette

- paling

- palm

- pampers

- panel

- panels

- panggang

- pangsit

- panther

- paper

- papers

- paragon

- pare

- parents

- parivar

- park

- partner

- party

- parvati

- paste

- pastel

- pattern

- patterns

- pattinson

- patty

- pauk

- paulo

- pbteen

- pear

- pecel

- peel

- pekalongan

- pencils

- pengembang

- pens

- people

- perennial

- perfect

- perfume

- pernikahan

- personalized

- pertussis

- pete

- pexels

- pfizer

- phone

- phones

- phonics

- photo

- photography

- photos

- photoshop

- physical

- piano

- piche

- pick

- pickup

- picnic

- pics

- picture

- pictures

- piece

- pieces

- pikachu

- pillows

- pindang

- pine

- pineapple

- pink

- piping

- pisang

- pitbull

- pixel

- pixellab

- place

- plaid

- plain

- plan

- plane

- plank

- planner

- plans

- plant

- play

- playstation

- plug

- plurals

- plus

- plush

- pneumococcal

- pneumonia

- pneumoniae

- podcast

- poetry

- point

- points

- pokefind

- pokemon

- pokémon

- polio

- poliomyelitis

- polka

- polymer

- pooh

- pool

- popular

- porsche

- portable

- portada

- portland

- portrait

- portuguese

- postcard

- poster

- posters

- pots

- potter

- potty

- powder

- powerpoint

- practice

- praktis

- prayer

- premier

- premium

- premiums

- preschool

- preschoolers

- preserve

- press

- prevnar

- price

- prices

- primitive

- princess

- printable

- printables

- printer

- printers

- prints

- privacy

- problem

- problems

- procreate

- products

- professional

- profile

- programme

- projector

- promotion

- propeller

- property

- proposal

- protein

- proteins

- puasa

- pudding

- puding

- pull

- pulsar

- pumpkin

- puppies

- puppy

- pups

- pura

- purchase

- purple

- purpose

- puzzlers

- qatar

- quadrivalent

- quality

- quarter

- queens

- questions

- quirky

- quote

- quotes

- rabies

- race

- racing

- radha

- radhe

- radios

- radno

- raichu

- raid

- rain

- rainbow

- rainforest

- raised

- randalls

- range

- rappers

- rare

- ratio

- rdna

- reaction

- reactions

- reader

- reading

- real

- reality

- rebel

- receive

- recharge

- recipe

- recognition

- recycle

- redskins

- regency

- registration

- registry

- reindeer

- religious

- removable

- remove

- rendang

- rent

- rental

- rentals

- renyah

- repeat

- replace

- reporting

- repsol

- required

- research

- resep

- reset

- resin

- resize

- resolution

- resort

- response

- resume

- retro

- reverse

- review

- reviews

- rias

- ribbon

- rica

- riddles

- ring

- rings

- risol

- road

- robinson

- roblox

- rock

- rohanpreet

- roku

- roll

- romania

- romantic

- ronaldo

- ronde

- roofing

- room

- rooster

- roots

- rose

- rosegold

- roses

- rotavirus

- roti

- route

- rover

- royalty

- rubicon

- ruby

- rule

- rules

- running

- rustic

- ryan

- safe

- safety

- sage

- sagu

- saint

- salary

- sale

- salep

- salle

- salmon

- sambal

- samsung

- sana

- sand

- sandwich

- sanei

- sanjai

- santan

- sapi

- sapo

- saraswati

- sarden

- sars

- sate

- saucer

- saus

- sayings

- sayur

- sayuran

- scale

- scar

- scenery

- schedule

- schotel

- sciatica

- science

- screen

- screensaver

- screensavers

- script

- scroll

- sculpture

- seafood

- seahorse

- search

- seasonal

- seasons

- second

- secret

- security

- sederhana

- sell

- semprit

- semur

- send

- sendok

- sengkang

- seniors

- september

- sequence

- serabi

- serba

- serenity

- series

- service

- sesame

- sets

- setting

- setup

- seuss

- sewa

- shade

- shadi

- shadow

- share

- shark

- sheet

- sheets

- shelter

- sherawali

- shihlin

- shingles

- shiny

- ship

- shiplap

- shipping

- shirt

- shirts

- shiv

- shiva

- shock

- shoes

- shop

- shops

- Short

- shots

- show

- shree

- shri

- shrub

- sickle

- side

- siemens

- sign

- silas

- silhouette

- silver

- simple

- sindri

- singh

- singkong

- single

- siri

- sister

- sites

- size

- skateboard

- skills

- skirt

- skull

- skyline

- sleepers

- slip

- small

- smart

- smartphone

- smartwatch

- smell

- smoke

- snapchat

- snapshot

- sneaker

- sobek

- sober

- soccer

- social

- sociedad

- sofascore

- software

- soil

- some

- sommelier

- song

- songs

- sosis

- soto

- sotong

- sound

- sounds

- soup

- source

- south

- space

- spaghetti

- spanish

- speaker

- speakers

- spectra

- spell

- spelling

- spend

- spesial

- spider

- spiderman

- spinach

- spirit

- splash

- split

- spongebob

- Sport

- sportback

- sporting

- sports

- spot

- spreadsheet

- spring

- sprinkler

- square

- squash

- squat

- stadium

- stage

- staging

- stake

- stand

- star

- starbucks

- starry

- stars

- starship

- state

- stationery

- statue

- steak

- steam

- steel

- steelers

- stefani

- step

- stick

- sticker

- stickers

- sticks

- stiletto

- stitch

- stock

- stop

- store

- stormy

- story

- stove

- strain

- strap

- stream

- streaming

- street

- strep

- striped

- strips

- strokes

- structure

- students

- studies

- study

- stuffed

- stump

- stunning

- style

- stylist

- subtraction

- subtrction

- subway

- suggestions

- summer

- sunny

- sunset

- super

- superhero

- superman

- support

- supreme

- surrogate

- susu

- swarovski

- swimming

- swiss

- switch

- swollen

- sword

- syndrome

- syringe

- systems

- table

- tablet

- tabs

- tacoma

- tahan

- tahu

- take

- takoyaki

- talam

- talas

- talk

- tamil

- tanah

- tanpa

- tape

- target

- tatak

- tattoo

- tauco

- tauto

- tdap

- teacher

- teachers

- teal

- team

- tears

- teddy

- tekwan

- tela

- teler

- televisions

- telur

- temperate

- template

- templates

- tepung

- terang

- terbaru

- teriyaki

- terong

- terrace

- terrarium

- test

- tewel

- texas

- text

- tfsi

- thank

- thanksgiving

- themed

- themes

- therapy

- there

- thinking

- thirupathi

- thomas

- three

- threshold

- through

- thunder

- tian

- tick

- tickets

- tiger

- tiktok

- tile

- tiles

- time

- timed

- timeless

- timothy

- timun

- tint

- tiram

- today

- tojin

- tokyo

- tongue

- tony

- toppers

- touring

- tournament

- towing

- toxic

- toyota

- toys

- trace

- tracing

- tracker

- tracking

- tractor

- trading

- tradisional

- traditional

- train

- trainer

- training

- trancam

- transformers

- transparent

- travel

- treat

- tree

- trek

- trevor

- trial

- trim

- tropical

- trucks

- trump

- trusses

- tteok

- tuberculosis

- tubes

- tulip

- tumblr

- tuna

- tundra

- turkey

- turtle

- tuscan

- tuscany

- twig

- type

- types

- typhoid

- typing

- udang

- uktra

- ultra

- umami

- unbanned

- uncharted

- uncooperative

- under

- understanding

- unemployment

- ungkep

- ungu

- unicorn

- unik

- unique

- unit

- united

- university

- unopened

- unsplash

- untuk

- update

- user

- vaccinated

- vaccination

- vaccinations

- vaccine

- vaccines

- valuable

- value

- vans

- varicella

- vector

- vegetable

- vehicle

- vellum

- velvet

- venkateshwara

- venue

- venues

- vera

- version

- vertical

- very

- victorian

- vida

- video

- videos

- view

- vineyard

- vintage

- vinyl

- vishnu

- vision

- vlog

- vocabulary

- vogue

- voice

- vows

- vrijeme

- vsco

- wall

- wallpaper

- wallpapers

- walls

- walmart

- warfare

- waroeng

- warp

- wash

- washington

- watch

- water

- watercolor

- watercolors

- waterfall

- watermark

- waterproof

- watson

- wave

- waves

- wayfair

- weather

- website

- websites

- wedang

- wedding

- weight

- weird

- welcome

- west

- what

- when

- where

- which

- while

- white

- whooping

- wide

- wife

- wiki

- wild

- will

- william

- window

- windows

- wine

- wings

- winnie

- winsor

- winter

- wireless

- wireshark

- wish

- wishes

- wisman

- with

- wizard

- woman

- women

- wont

- wood

- wooden

- word

- words

- work

- worksheet

- worksheets

- workshop

- world

- wrangler

- wreath

- write

- writing

- wuluh

- xbox

- xmas

- yacht

- yang

- yard

- year

- yeezy

- yeezys

- yellow

- york

- your

- yourself

- youtube

- youve

- zebra

- zion

- zipper

- zombies

- zone

- zoom

- zurich

-

For most people they will get Prevnar 13 in childhood and Pneumovax 23 in their senior years. Administer 1 dose of PPSV23. Pneumococcal Va...

-

Once cut into each card you can laminate the cards before distribution. Prayer Cards for Kids. Free Prayer Cards Printables A Cowboy S Wif...

-

Medicare You Handbook 2020 Idaho Department of Insurance. _____ doesnt pay for laboratory testing below you may have to pay. Abn 48 123 12...